Post

Unpacking the power of OmniTraffic® Data: insights from chip searches in the online grocery market.

In the post-COVID era, the surge in online grocery shopping has become a significant trend,…

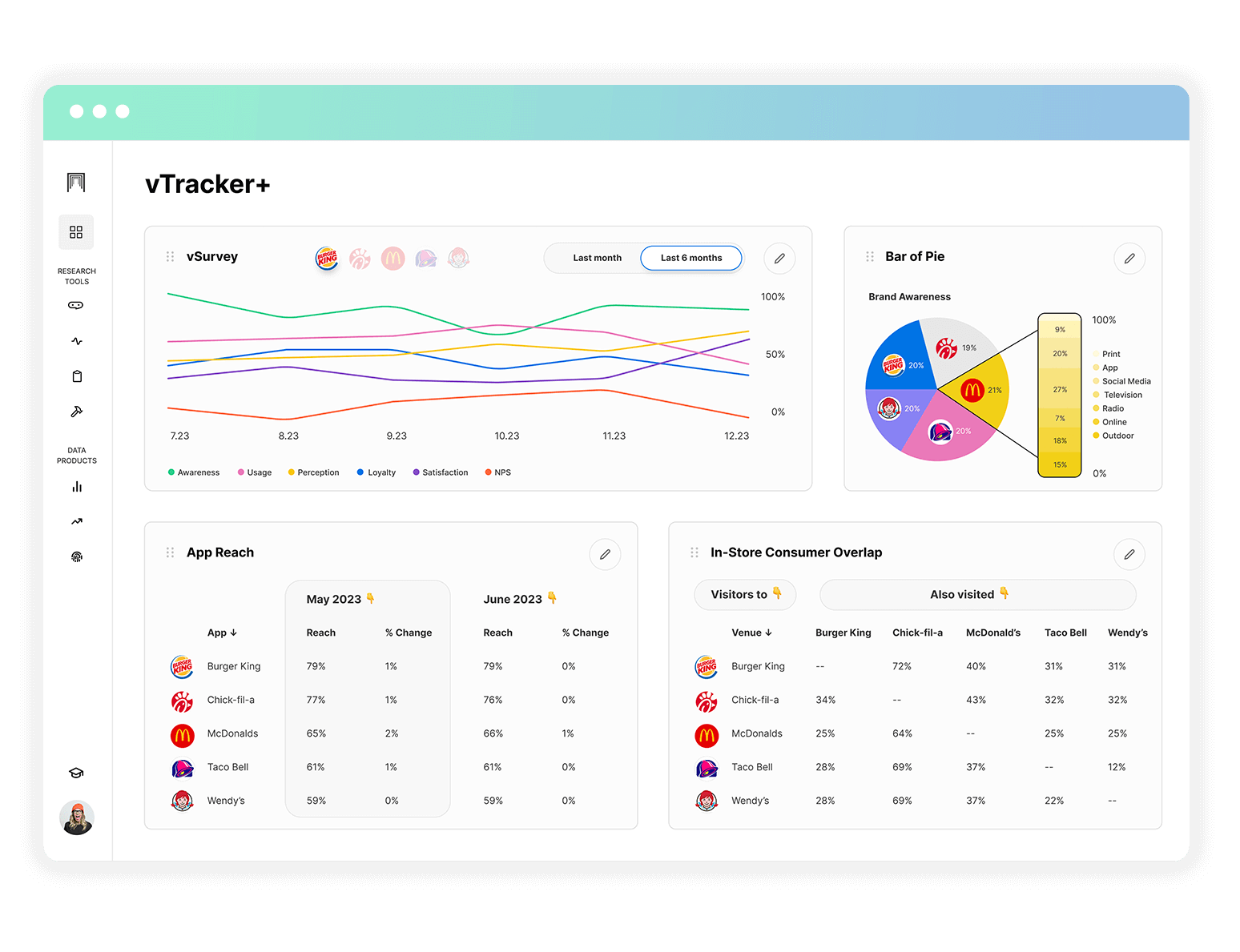

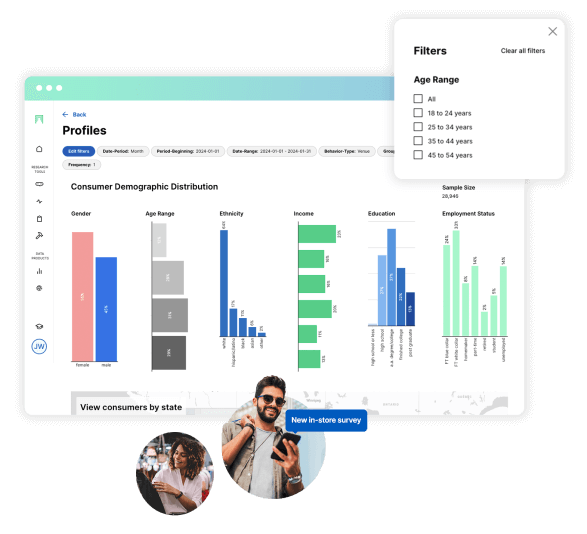

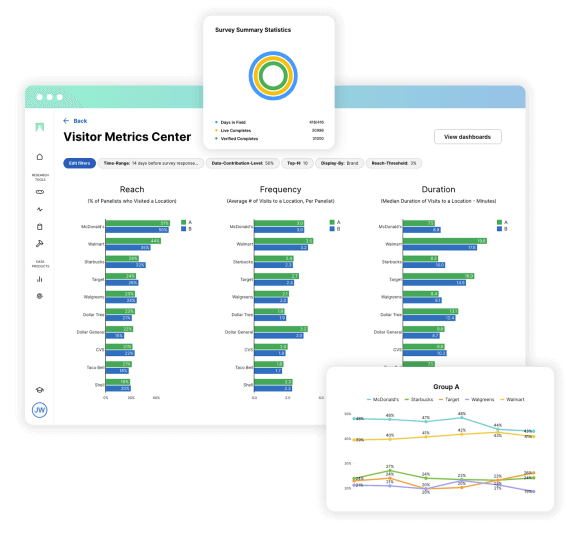

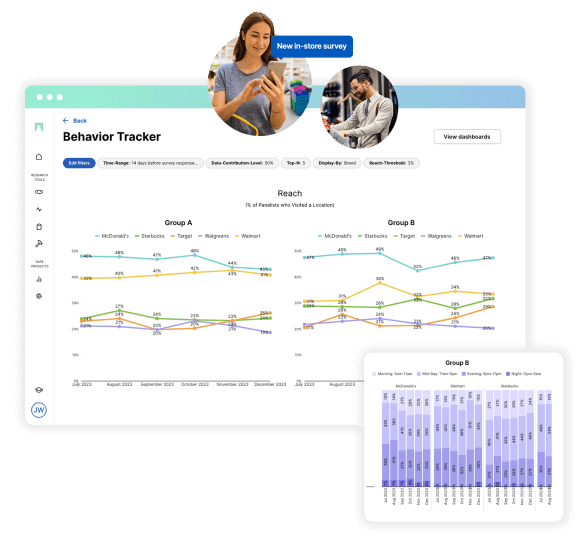

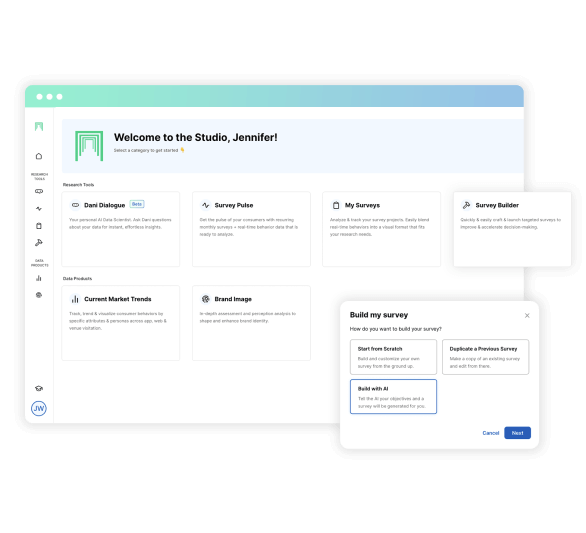

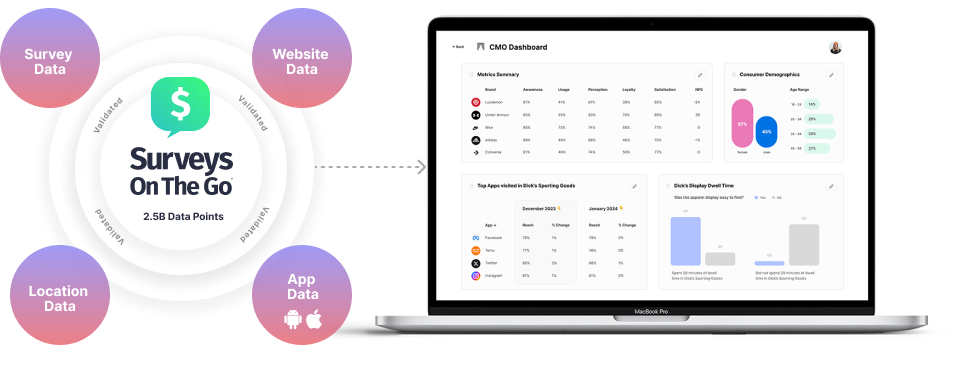

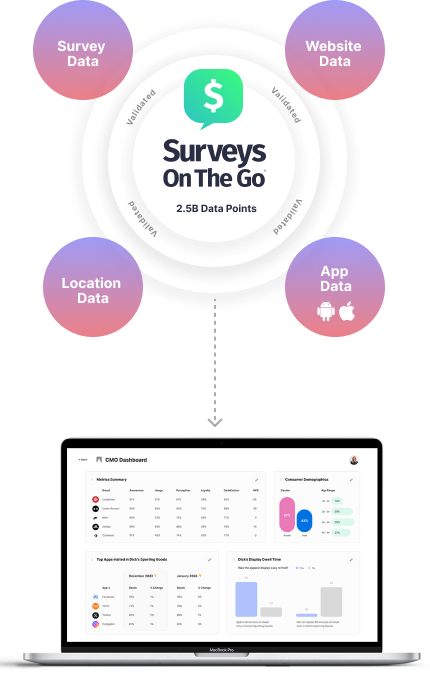

MFour blends validated survey data + behavior data to give you real-time insights visualized on one user-friendly platform.

TRUSTED BY COMPANIES LARGE & SMALL

Chris St. Hilaire, CEO of MFour Mobile Research

Tab 2 content.

Dr. Gavan Fitzsimons, Professor of Marketing and Psychology

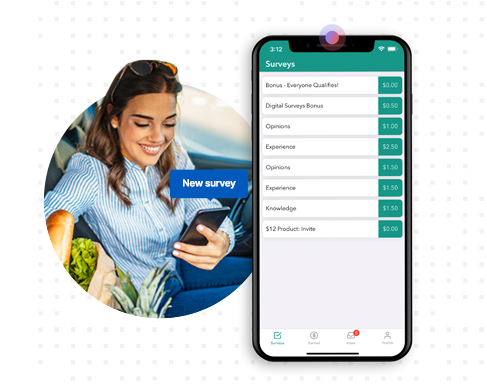

Your consumers are always active, your research should be too.

App, Web & Location Events

Updates daily.

Choose Audience

Behaviors

Create or Use

Survey Service

Launch &

Monitor Surveys

Analyze &

Interpret Results

Share Findings in Reports

or Dashboards

Today’s consumers are complex, and so is their data. Just a survey won’t cut it; you need to add app, web, and location data to truly understand what consumers want, bridging the gap between what they say and what they do.

v = Validated consumers

+ = app, web, and location behavior data

Stay up to date on consumer trends by opting into our newsletter.

See how MFour can enhance your business through validated market research — book a demo today.

In the post-COVID era, the surge in online grocery shopping has become a significant trend,…

As the field of market research evolves, so too does the means by which insights…

Introduction In the dynamic world of market research, or over the last decade, the “not…