Industry Report

The Best Way to Help Your Clients Understand the Need for Validated Market Research

As data fraud continues to threaten the reliability of survey-based insights, market research firms have…

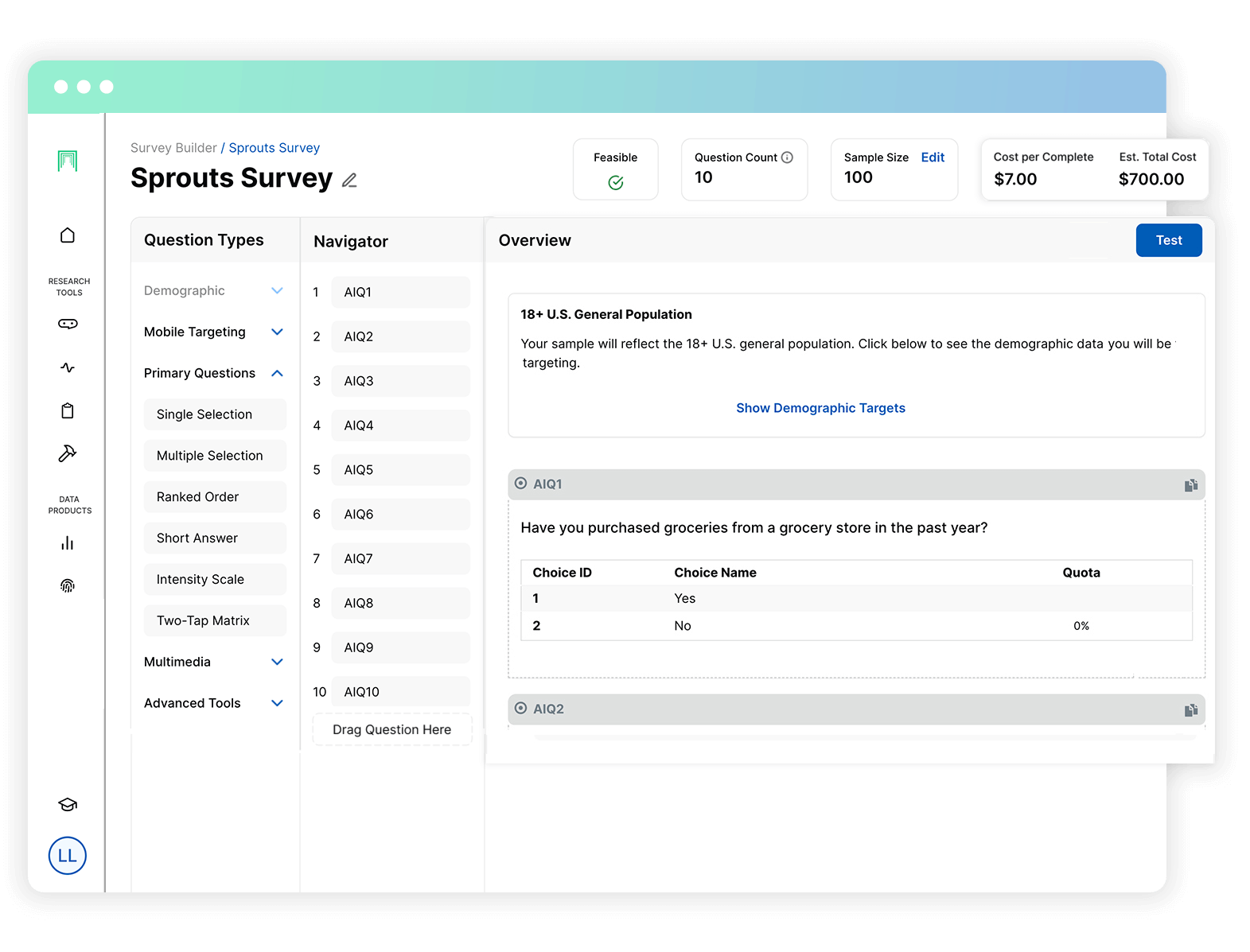

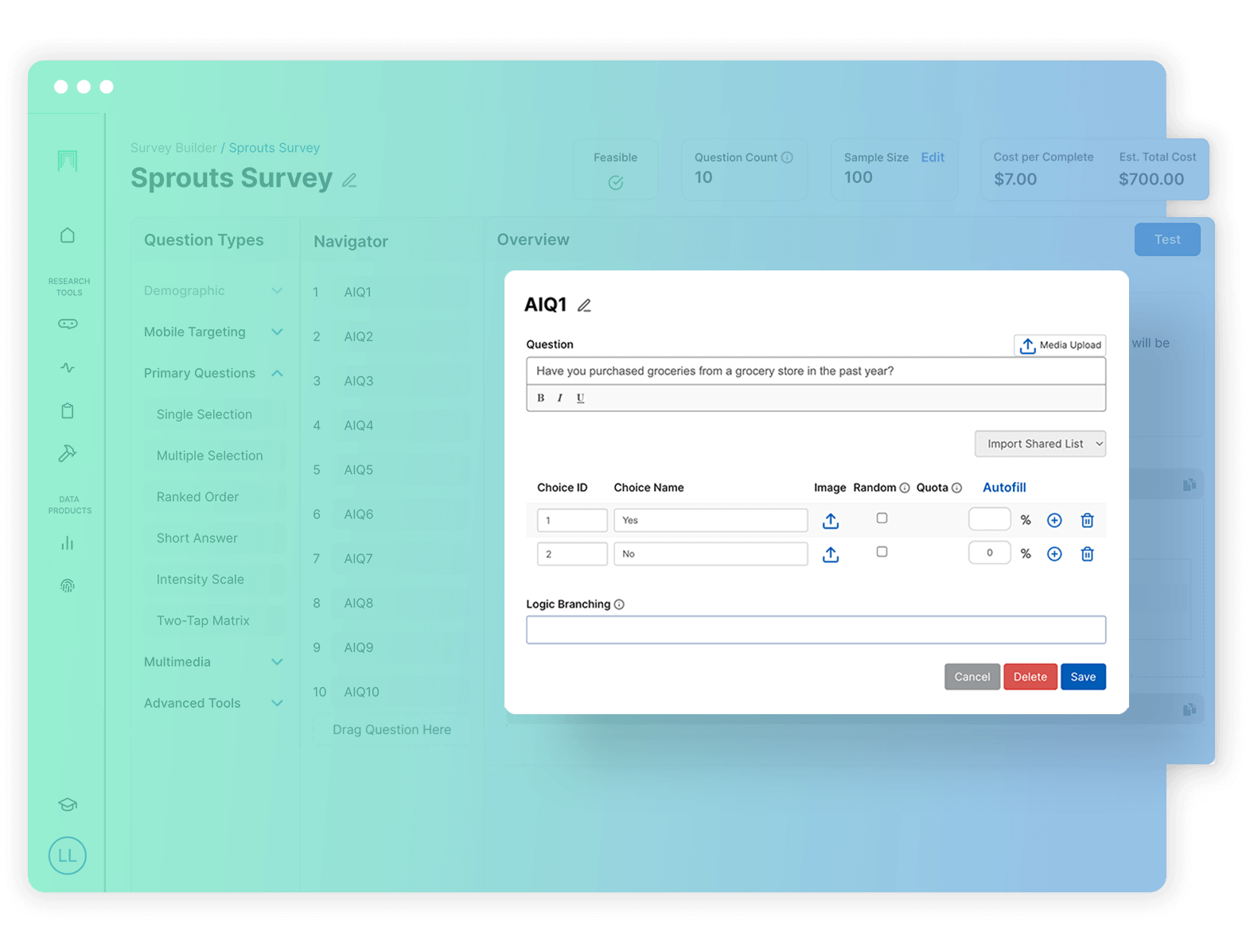

The most dynamic DIY survey tool on the market

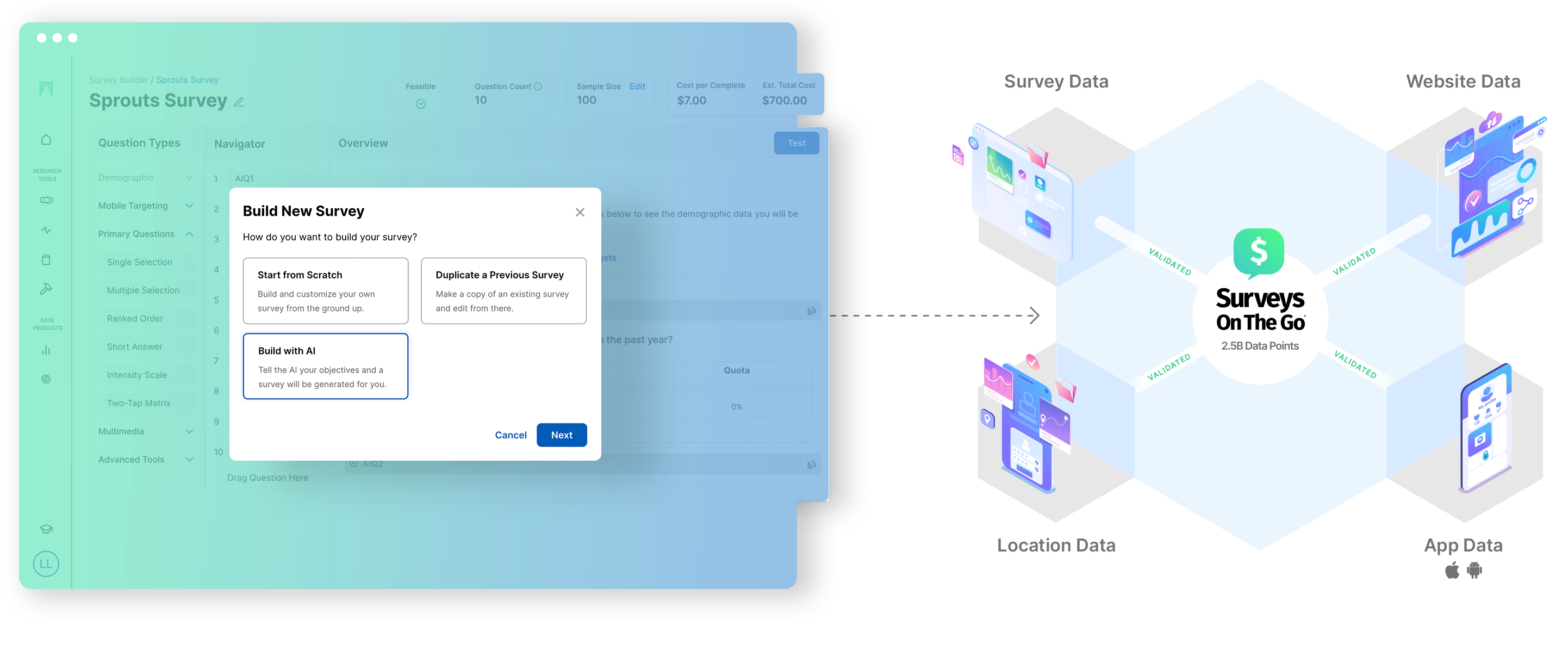

AI Survey Builder, integrated with Surveys On The Go®️, the largest mobile panel in the U.S., simplifies the creation of tailored surveys.

Our AI-powered survey tool leverages advanced algorithms and over a decade of survey creation data for improved efficiency and accuracy.

Efficiency, quality, & integration

Reduce Time & Costs

Focus on valuable survey insights instead of getting caught up in the complexities of survey design.

Eliminate Personal Biases

Improve the quality of survey questions for enhanced decision-making based on reliable and unbiased data.

Combining AI & Surveys

Streamline the survey-building process by eliminating the need to switch between different tools and platforms.

Simple & seamless

Step-by-step survey creation in seconds.

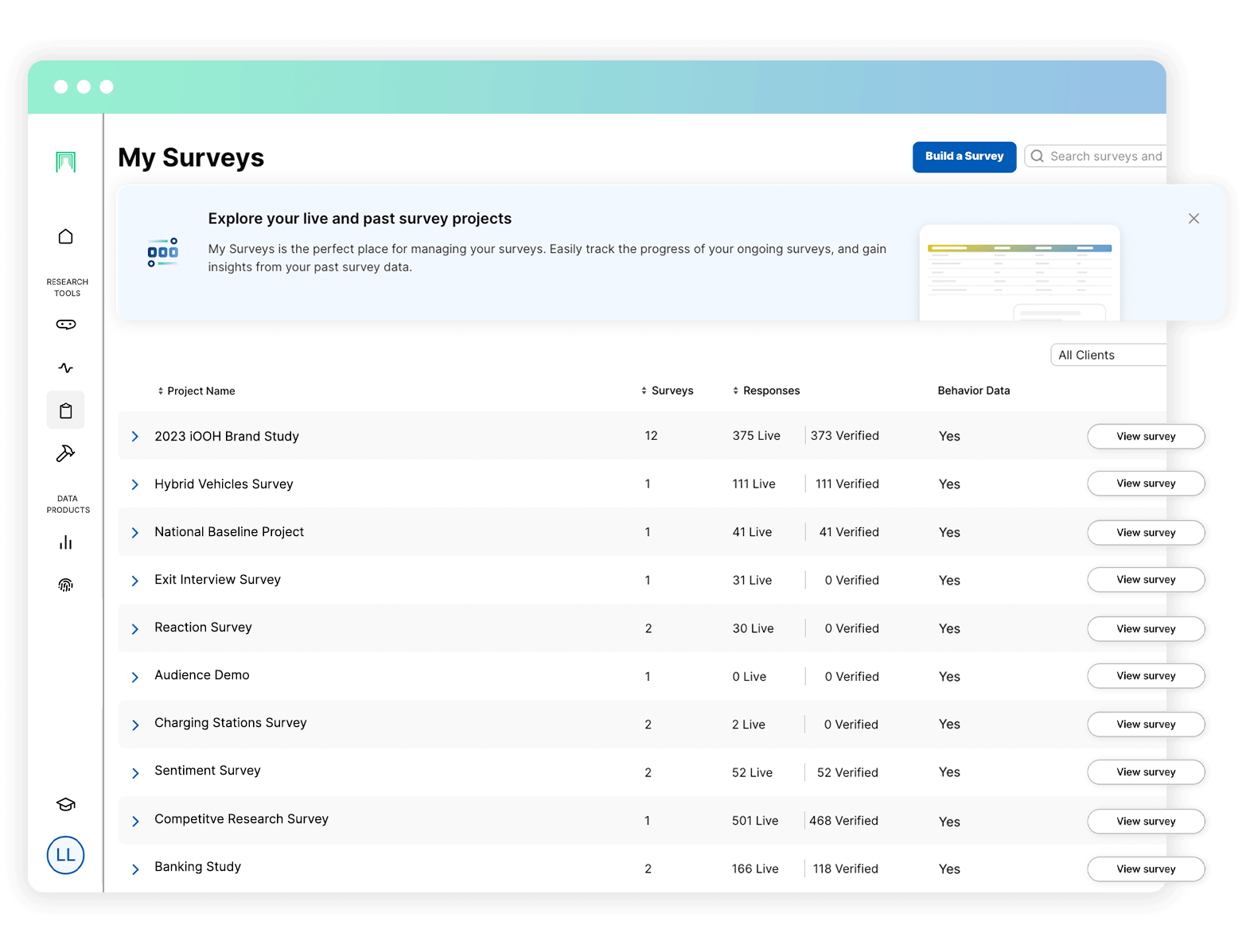

Stored in Studio all your survey projects for easy access and usability. Switch effortlessly between active and past projects. Analyze valuable customer data by thoroughly reviewing their responses.

Gain a crucial look into your customer’s behavior through app, web, & location data.

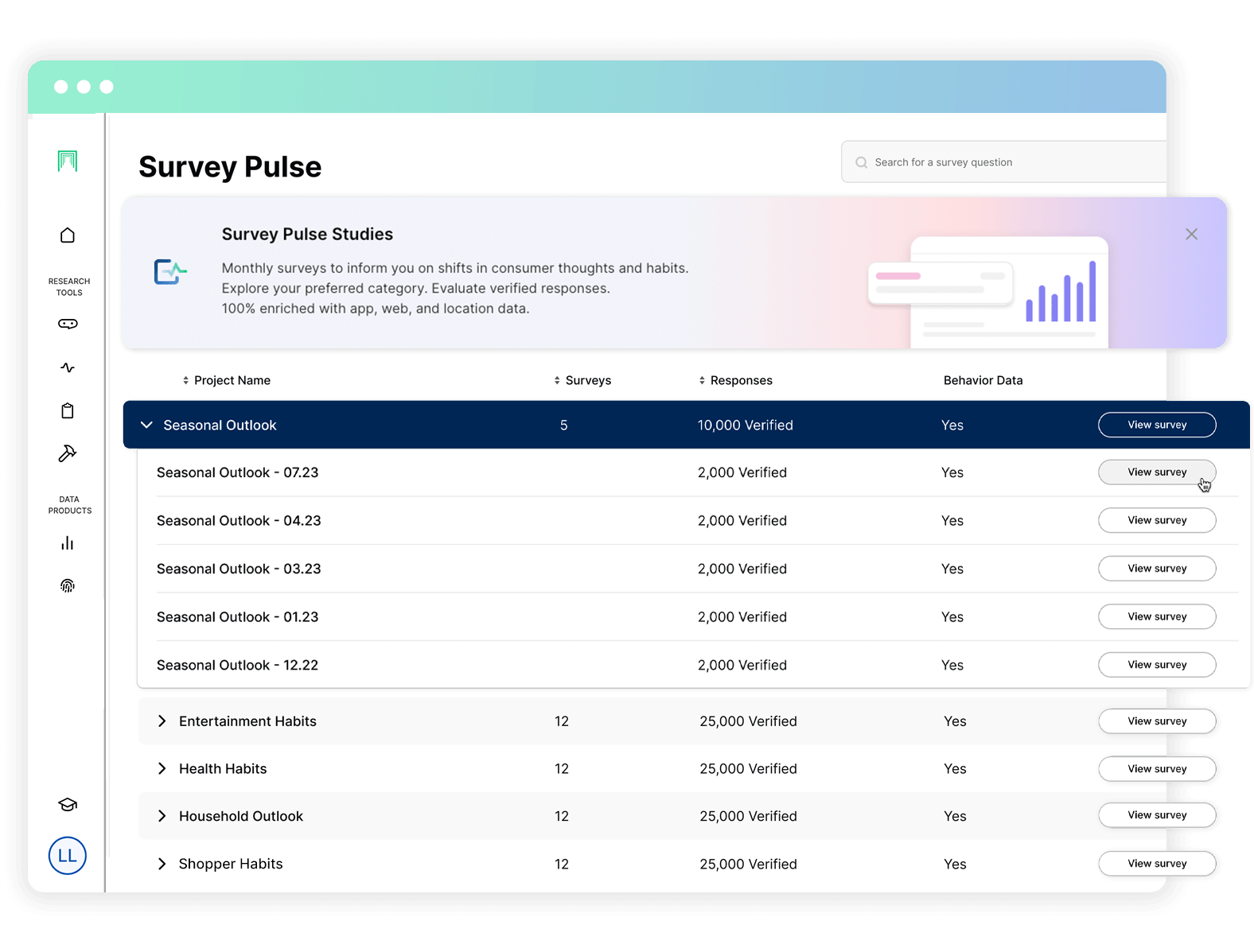

Stay informed about shifting consumer thoughts and habits every day with our industry surveys. Delve into your preferred category and evaluate verified responses that are 100% enriched with app, web, and location data.

Keep your company’s hand on the pulse of your industry. Without an active survey project.

Short on time? Not ready for a full survey? We get it – With studio, you have additional tools that help you get the data you need when you need it.

Are you looking to ask a targeted question without conducting an entire survey? With an Omnibus survey, you can include your specific questions in a shared survey for a flat rate. This cost-effective approach allows your business to gather valuable information while taking advantage of economies of scale.

Additionally, Omnibus questions are enhanced with behavior data, providing a comprehensive view of your customer.

See how MFour can enhance your business through validated market research — book a demo today.

As data fraud continues to threaten the reliability of survey-based insights, market research firms have…

In the relentless pursuit of speed and cost-efficiency, market research stands at a crossroads. The…

Learn how MFour’s commitment to “fair trade data” and consumer validation is challenging industry norms…

Stay up to date on consumer trends by opting into our newsletter.