Eliminate competitive blindspots.

Turn trusted insights into smarter decisions, uncover growth opportunities, and stay ahead in your evolving competitive landscapes.

Outsmart your competitors with validated data.

Point of Emotion®

Capture feedback from competitors’ consumers within 24 hours of visiting a rival store, app, or website to uncover opportunities to outperform the competition.

Visit Pattern Targeting

Identify competitors’ consumers based on visitation patterns to trigger surveys that reveal insights into competitor performance, customer loyalty, and engagement strategies.

OmniTraffic® Data

Analyze competitor traffic and engagement across online and offline channels to better understand their consumers’ behaviors, preferences, and purchase journeys.

Stay ahead of your competition with insights you can trust.

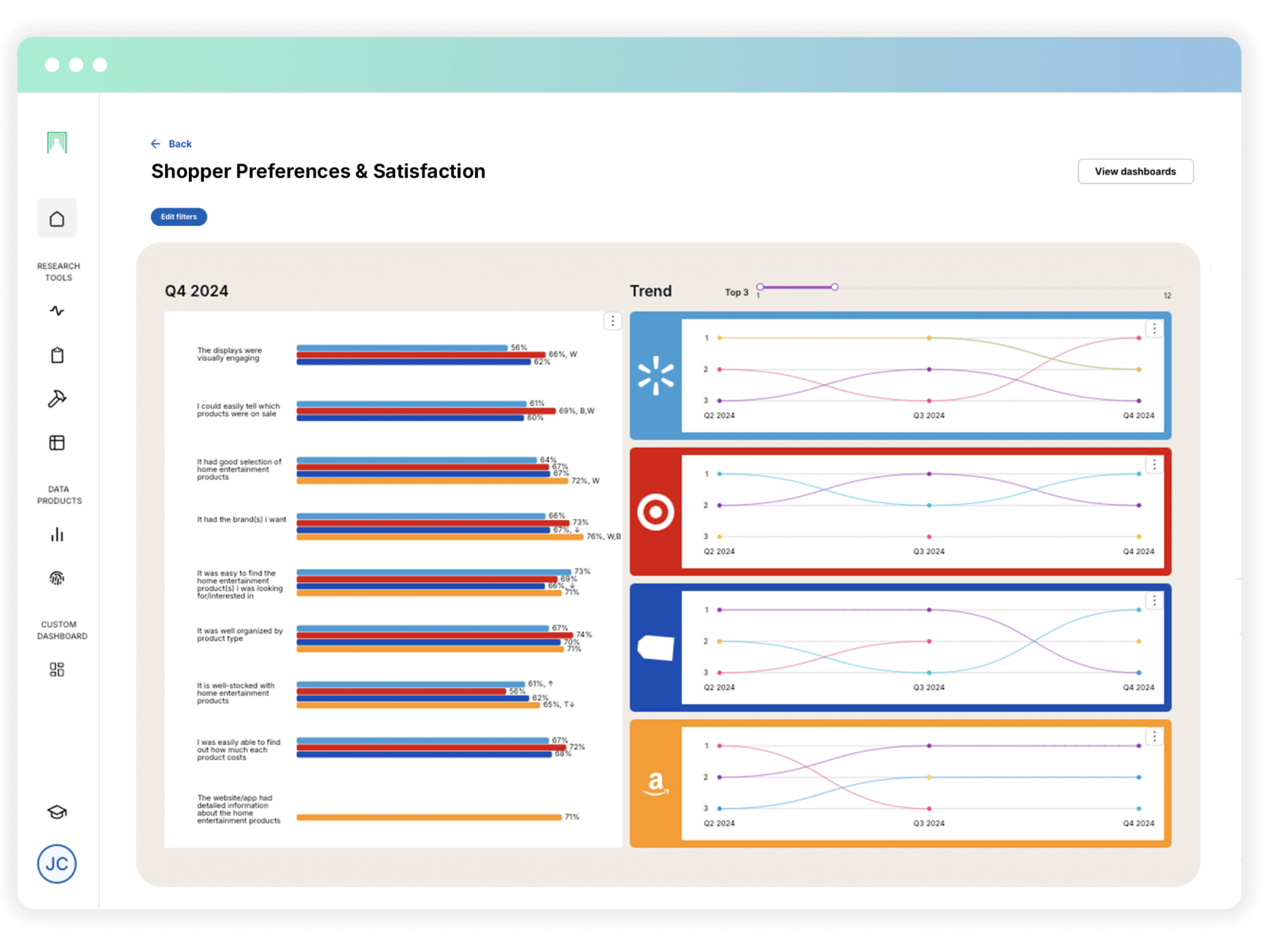

Compare side-by-side performance metrics to identify what strategies are working for them and how you can do it better.

Track trends, gather insights, and fine-tune strategies to stay relevant and competitive as consumer preferences evolve.

Gauge how consumers view your brand compared to competitors and uncover opportunities to build stronger connections and loyalty.

Refine messaging, optimize campaigns, and strengthen your value proposition to outperform competitors and capture more market share.

Analyze competitor offerings to uncover gaps and seize opportunities for new product launches or line extensions.

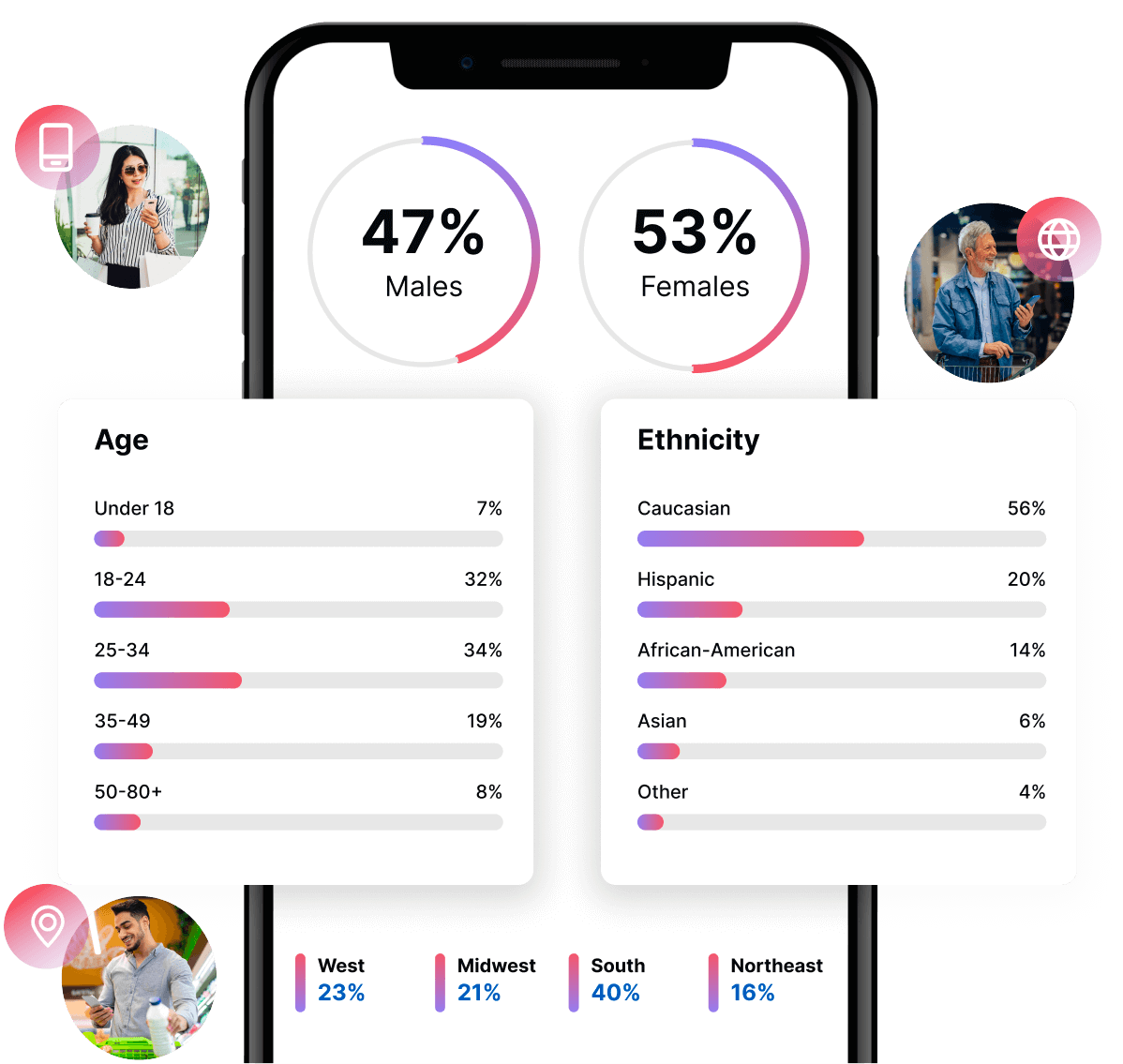

Own & keep every segment.

Unlock "hard to reach" demographics

Access consumers beyond traditional receipt or loyalty surveys, which often skew toward extreme experiences and satisfaction levels.

Learn from non-purchasers

Understand why consumers left your online store or property without purchasing, map their journey, and craft strategies to them win next time.

Convert competitor shoppers

Talk with those who shopped your competition to understand why and how you convert them to your brand.

Harness in-app intelligence

Uncover how users engage with your app and competitors’ apps to optimize journeys, analyze buying behavior, and refine strategies for a competitive edge.

Largest mobile audience

Capture the metrics that matter.

Survey

- NPS, CSAT, and CLV

- Share of Voice

- Likelihood to Switch

- Feature Importance vs. Satisfaction

OmniTraffic® Behaviors

- Path to Purchase

- Engagement Touchpoints

- App, Web, and Location Analytics

Ready to drive growth and outperform your competitors?

Learn more about vTracker+™