App-driven success:

Unveiling why 59% of cannabis buyers choose apps.

The goal.

How do you win market share in a brand-new area? Talk to the competition. Well, at least to their buyers. For a major Cannabis company, this meant asking consumers what made them choose a certain brand. The idea? Create a better customer experience and 86% will pay you more for it. Your brand: 1, the competition: 0.

But, there was a hill to climb. The new market for this Cannabis client was very familiar with the competition; they didn’t really know the client’s brand. This client needed to understand who their true target audience and product user was. To do it, they’d need to dig in deep, for consumer insights.

The result? 8 key insights that you can see for yourself here.

Create a better customer experience

and 86% will pay more for it.1

Research was required.

Cannabis consumers shop at dispensaries, but they also use apps. We’d need to help this collect data in-store—and on an apps. They’d need access to a panel of consumers who were willing to share their dispensary and app behaviors, so we could study them all.

Our approach.

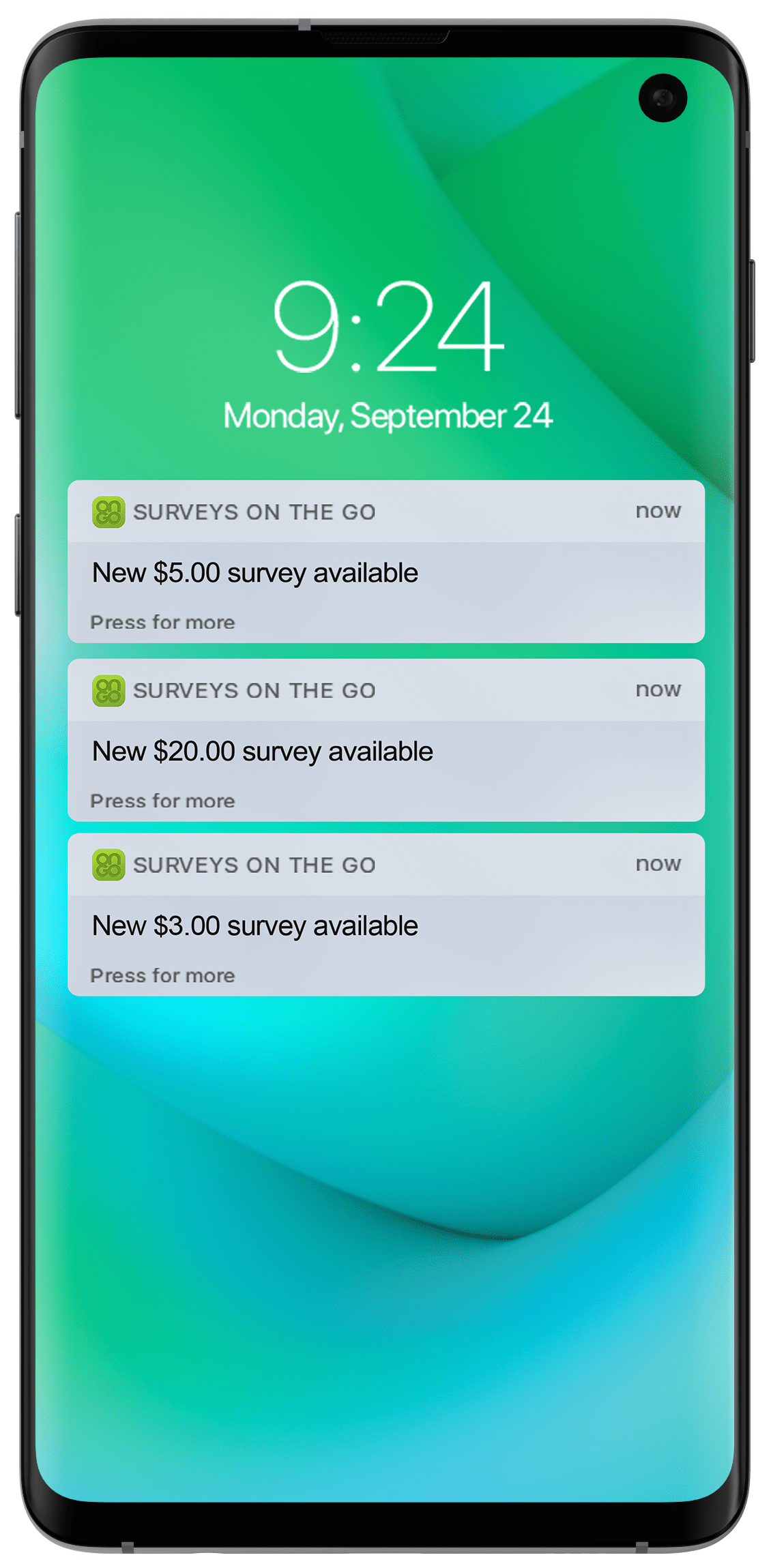

We used Surveys On The Go® (SOTG).

As the nation’s largest, highest-rated consumer panel, SOTG locates consumers in real-time. Here, the app triggered a survey to people who had accessed a Cannabis app, or visited a dispensary, within hours of the action taken. All within the client’s requested market area.

And, cause it’s an app, the client got:

- eCommerce behavior: SOTG confirmed their use of a Cannabis app on their phone.

- Dispensary actions: GPS was used to track each panelist’s location, with their consent.

- Accurate data: Panelists were spoken to in real time, and validated via the SOTG app.

The results.

- Shoppers spend an average of $70 in flow and vape products, so it’s worth investing. Marketing efforts should increase awareness in both dispensaries, and on apps, because:

- 59% research on apps first.

- 51% decide while they’re in the store.

- 41% decide the same day, or within a few hours of their purchase.

- Consumers listen to what they’re told in-store. So, dispensary relationships are key, and a great way for new buyers to try the brand. After all:

- 46% chose this brand based on value for the price.

- 43% bought the brand because they associate it with quality.

- 40% picked up the client’s brand after the budtender recommended it.

- Cannabis apps matter. Buyers who research ahead of time use apps and the internet over recommendations. The client must be ready to promote their brand. In fact:

- 45% bought this client’s brand because they wanted to try something new.

- 39% look at promotions sent to them by dispensaries or Cannabis companies.

- As a result of the research, the client found they had poor coverage in certain areas. With the feedback they received from consumers, particularly those who knew their competition, they were able to adjust their approach and create a better go-to-market strategy.