So – who wins – in-store or online? The answer is … it depends. See, 96% of people will research a big purchase online long before they make it. And, while electronics can be small in size, they’re certainly large in price tag. Certainly, they qualify as a big purchase.

So the question remains …in-store or online?

Well, if you can capture a consumer online while they’re looking at prices, it stands to reason that they’d just buy online too.

Wrong.

C’mon, life isn’t that easy. It’s why we do B2C research. In this study, we found that 7 in 10 buyers will go inside Best Buy to shop, after they do research online. Basically, they’re trying to kick the tires for your products in person. That makes sense. Best Buy offers a lot of electronics. So, does everyone buy in-store then? Nope.

All buyers aren’t created equal.

As we dig into the details to answer your questions, keep this in mind.

Your target market goes into a store – either online or physically – with a job in mind. By the time they get to you, they’ve already associated your store with its ability to solve their issue. In this case, the issue is to buy electronics, and they assess if you’re better in-store or online.

So, your perception impacts their decision: whether to buy in-store or online.

Here’s the proof.

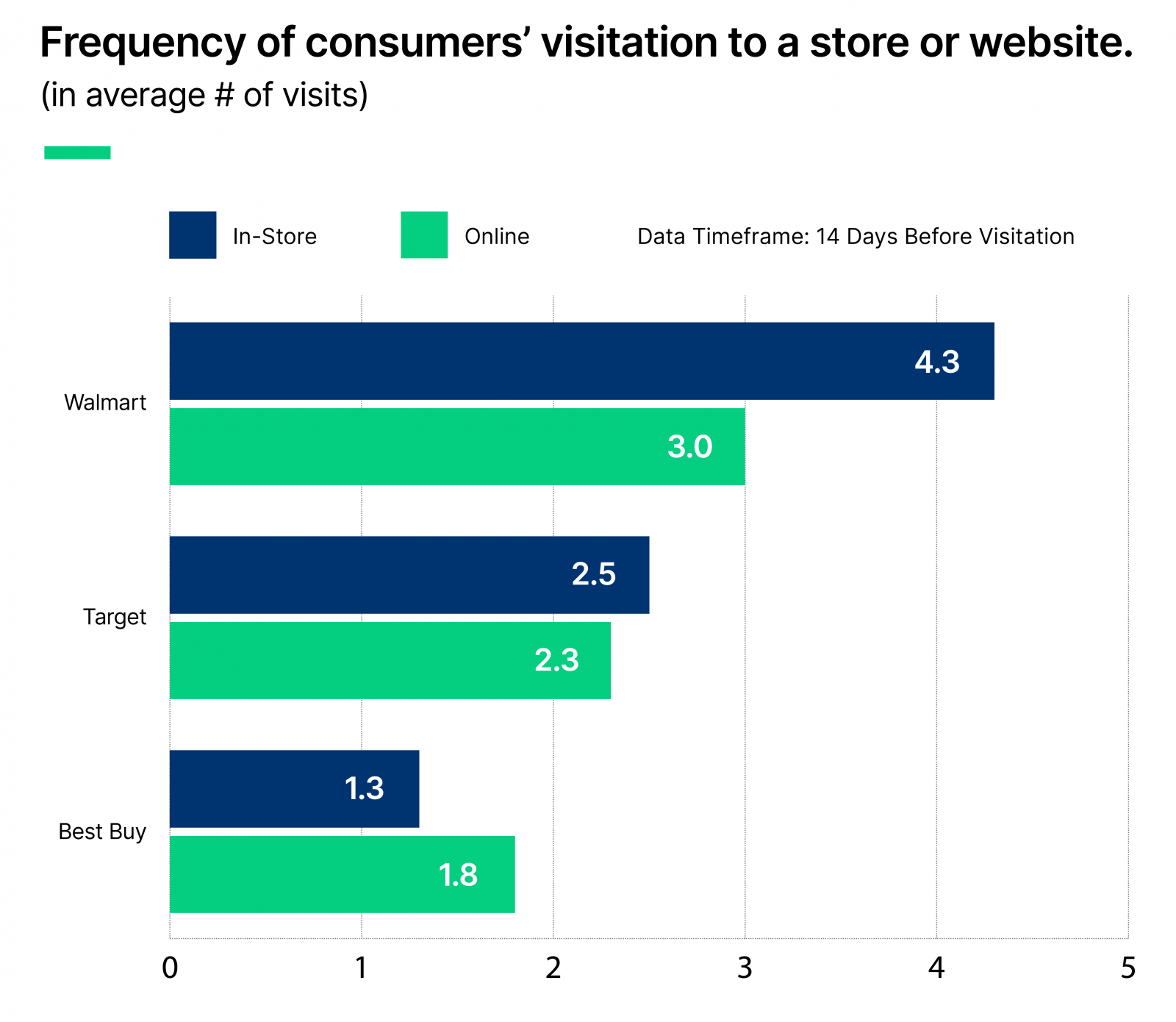

This isn’t rocket science. We’d expect online shoppers to frequent Walmart less than their in-store friends.

If we look at Target, their results are almost identical between in-store and online behavior when it comes to electronics. Meanwhile, Best Buy shows a greater propensity to buy online.

Let’s keep going. The data indicates Best Buy and Target have a greater ability to deliver online than Walmart. Now, on the surface you may not see that. After all, consumers say Walmart beats Target for the best online shopping experience.1 So, how can Target win in online sales?

Take a look.

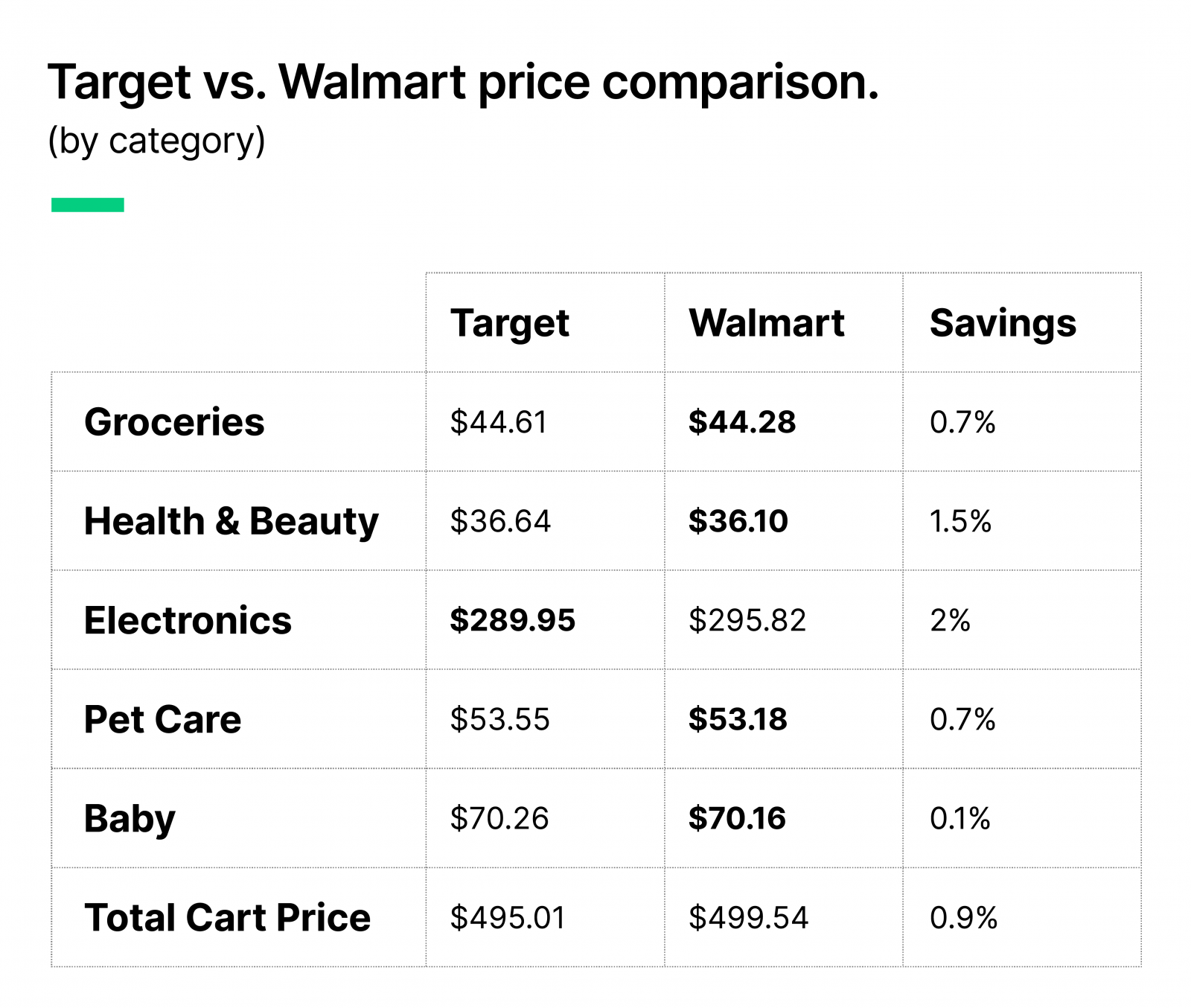

The devil’s in the details.

Notice that Walmart beat Target’s prices in all categories, but one – electronics. Here, Target is the clear winner. While Walmart may offer a great online experience, when it comes time to buy electronics, Target is going to get more online shoppers than Walmart will.

So, what about Best Buy?

You see the opposite. While 68% of in-store shoppers visit the website at some point, only 49% of online shoppers visit the store. These shopper insights tell us Best Buy online shoppers feel even more comfortable than Target or Walmart shoppers do, about buying their electronics online.

It also points to … an opportunity.

It’s time to maximize your cross-channel marketing.

Know your market.

At Walmart, you focus on in-store promotions and to sell electronics. Online ads will be less effective for Walmart buyers, who want to purchase your product in the store. So, budget accordingly. Reallocate your online ads, in-store ads that drive foot traffic data and sales.

At Target, you need both.

Here, your buyers are omnichannel retail shoppers. You’ll need to support Target buyers with ads that are online and in-store to properly promote your electronics. Adjust your advertising so that it’s a fairly even split to maximize sales. And remember, in-store shoppers are 2x as likely to spend more, so find ways to tie in your other products too, while buyers are there.

For Best Buy, you also need both in-store and online ads. But, realize that your online shopper is a lot more loyal to buying online, so really make it easy for him. Optimize your product page, shorten the click to cart time, and consider discounts for online orders. Above all, focus on quality – 59% say it’s what matters most in making a big purchase.

Need help?

You can access data on-demand for 599 million consumer journeys at no cost for 7 days. Start collecting insights now. Keep anything you find. After a week, it’s $100 a month to continue your search for insights.

References: