It’s 2 pm.

You’ve been staring at a screen too long. So, you stand up and walk to the pantry. You spy a tell-tale candy bar. And, as the orange plastic crinkles between your fingers, you tear it open.

Mmm.

Pulling back on a brown wrapper, your teeth sink into its rich, peanut-buttery chocolate shell.

Instant satisfaction.

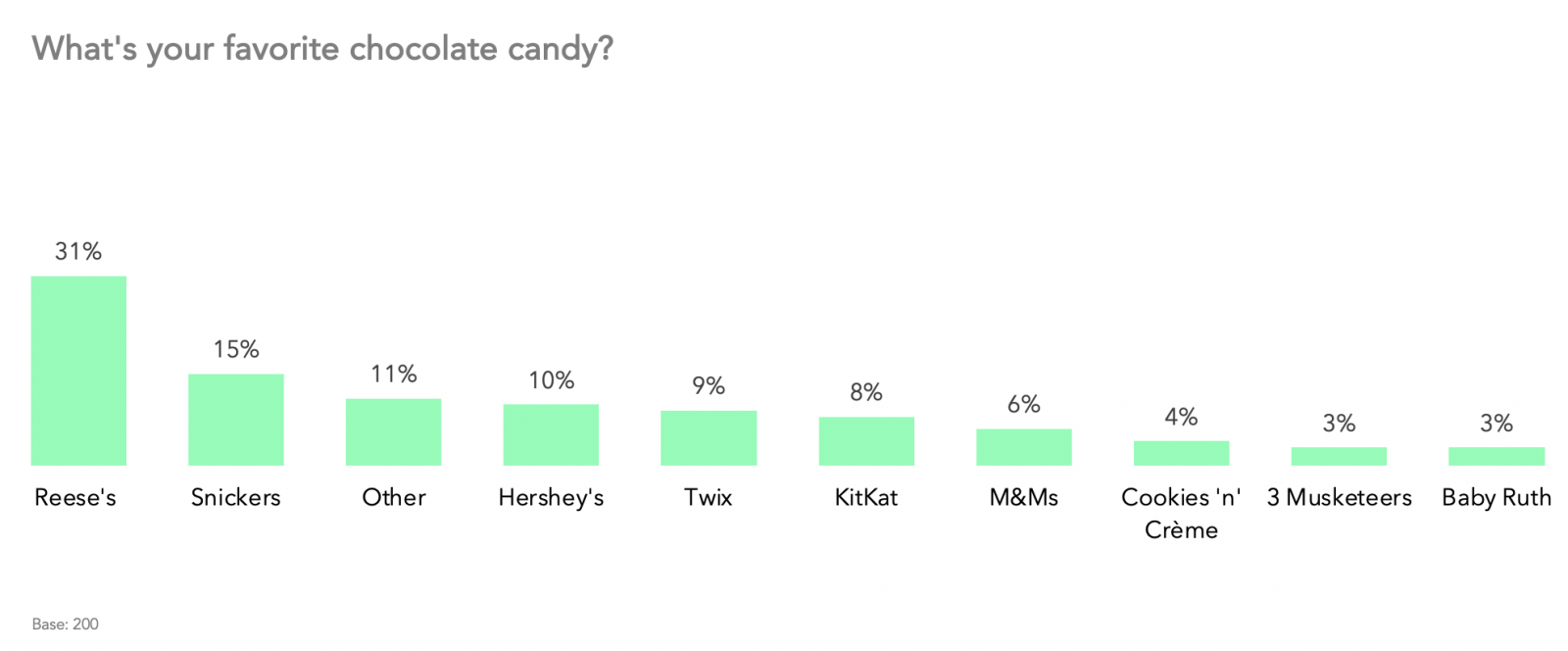

We talked to 200 Target shoppers cruising through candy displays.

And 31% said Reese’s was their favorite brand. Why? Well, 92% say they buy based on taste. I mean, it’s hard to argue with peanut butter + chocolate. But, they’re not alone in their love.

Not at all.

Whether it’s a sugar rush, the spike in serotonin, or just its yumminess — your consumers sure love chocolate. And, if you’re curious, 85% say they get it because it’s delicious.

Why they buy.

Here’s what else you should know.

Candy is craved. That’s why 76% buy it. In fact, if you’ve ever been pregnant like I have — you may be all too familiar with how it’s purchased. It’s triggered by a thought — or a visual. Once you’ve had it, you can’t get it out of your head, until you buy it.1

It’s an impulse.

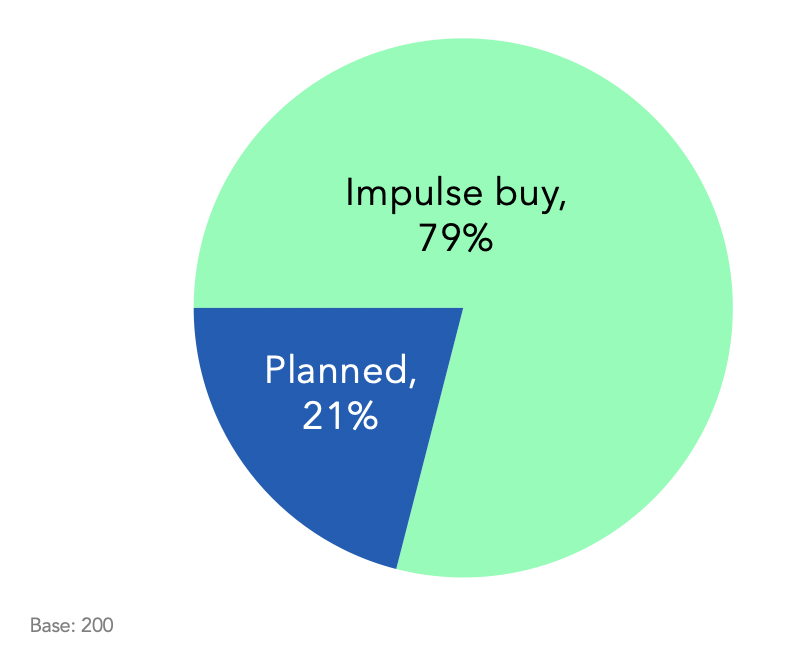

That’s right, 79% say candy is an impulse buy. Taste + craving = impulse purchase.

Do you tend to plan, or buy on impulse, when you purchase candy?

In the words of Ariana Grande: “I see it, I like it, I want it, I got it.” And, guess what — in a pandemic, people are more likely to impulse shop.2 Our own panel proves that’s true, with 39% more likely to buy candy on impulse now, than before lockdowns.

It’s comfort food.

Calories be darned. After all, what better pick me up is there, than a piece of chocolate? It’s a surefire way to increase serotonin. And, it’s why 41% are buying chocolate more during COVID.

Where they buy.

At big-box retail.

We all watched, as sales soared at certain retailers, right as everyone started to stockpile. Now, here we are a year later, and 73% are buying chocolate there too. The trend continues.

Which makes sense….because, what’s more impulsive than a candy display?

Every big-box retailer has one, after all. Which is great for the 82% who buy candy for themselves. They can wait in line, and grab candy on display, all while they pay. A win-win. So, while candy companies may think impulse buys are down— consumers say, it’s the opposite.

In fact, 31% are buying items on display more now, than before lockdowns.

A simple sale sign is all it takes for 58% to act. For another 37%, it’s a TV ad. That’s interesting — 72% say they usually see ads for chocolate on TV, so more than half are acting on it. That’s the power of craving. “I see it, I like it, I want it, I got it.”

So, how do you get them to buy more?

Glad you asked.

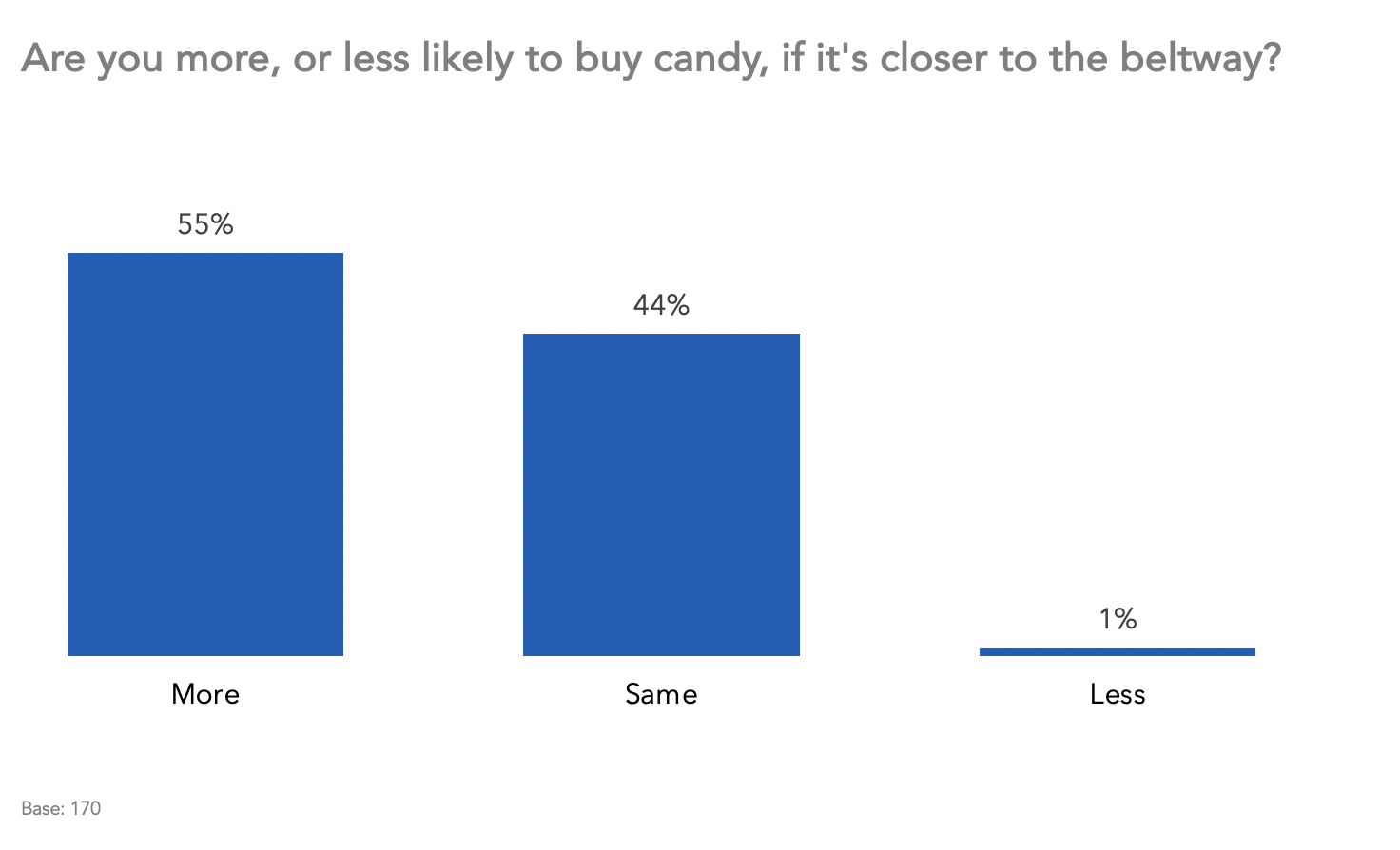

Focus on the beltway.

That’s where they’re looking. It’s where buyers set down their groceries and wait, while they check out. For, 85% of shoppers, it’s also where they saw candy on their Target trip.

Excellent.

Because 55% are more likely to buy candy, the closer it is to the beltway. So, now you have a location (beltway) — and a verification (our panel) of where to spend. And that’s important. After all, 43% are less likely to buy candy that’s further away from the beltway. So, stay close by.

The key is to work with retailers…and use data.

For retailers who are offering more self-checkout options right now, make sure they have a candy display at those locations. And, consider asking adding more display options for spaced-out stands, so consumers six feet apart, still have time to see your brand.

Need more research? Send us an email.

References: