Eggs.

Sigh…

If you need any indication of how outrageous grocery shopping is right now – please, do me a favor and try to buy a dozen eggs at the store. After you finish choking on the exorbitant price tag, we can talk more about skyrocketing prices .. and how they’re changing everything.

Again.

Yes, thanks to massive bird flu outbreaks, and a shrinking economy, shopping habits have shifted yet again. This is why we do research people, it’s been a rollercoaster ride when it comes to grocery shopping.

Not since 2020 have we seen a greater shift in spending.

So, what’s happening?

The tide is turning.

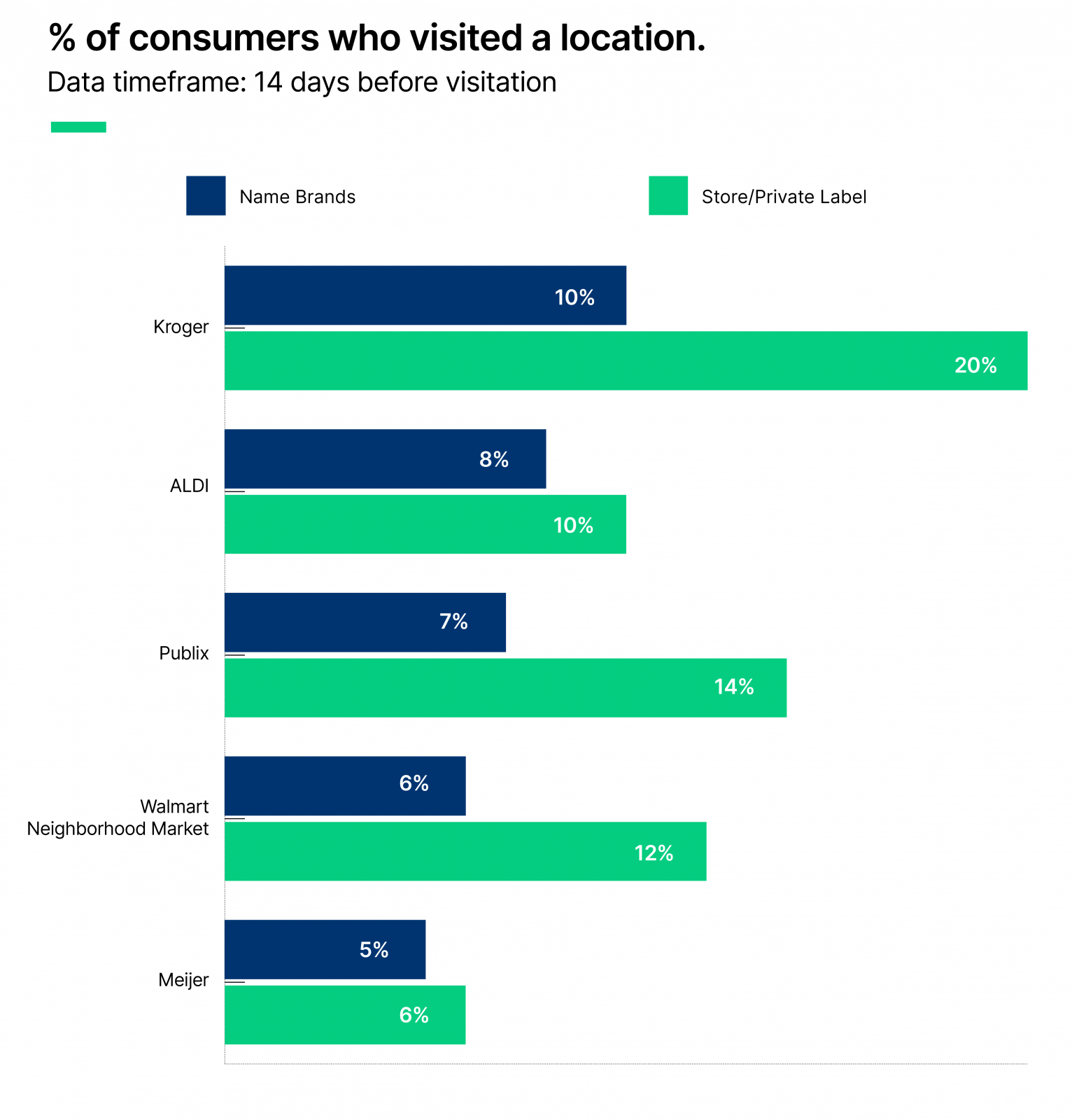

You’re seeing the water get a lot rougher out there for buyers. Here, take a look. What do you notice from the chart below?

You’re right.

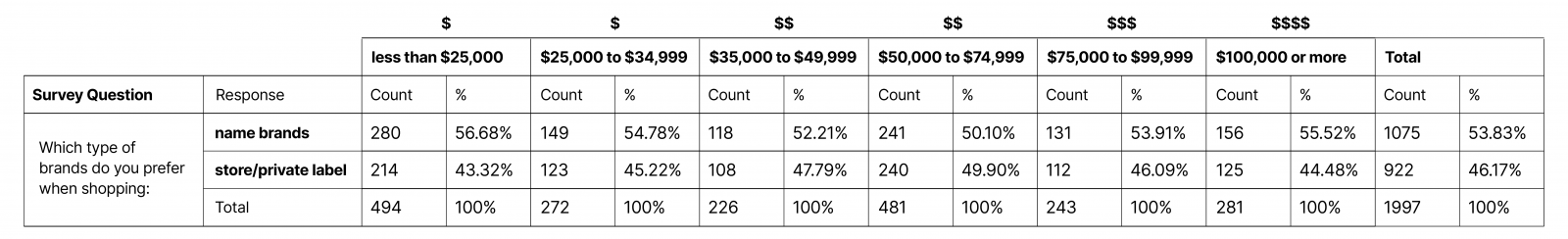

While consumers may prefer brand names to private labels, when it comes time to buy, everything changes. The higher your income, the more likely you are to go for a bargain, not for a big-name brand.

What?

Now that’s counterintuitive … or is it?

Not really.

See here’s the thing about wealth. There are two ways to get it: earn more or spend less.1 In the case of an uncertain economy – when all signs point to a recession – buyers have made up their minds. They’re choosing to spend less.

Here, I’ll show you.

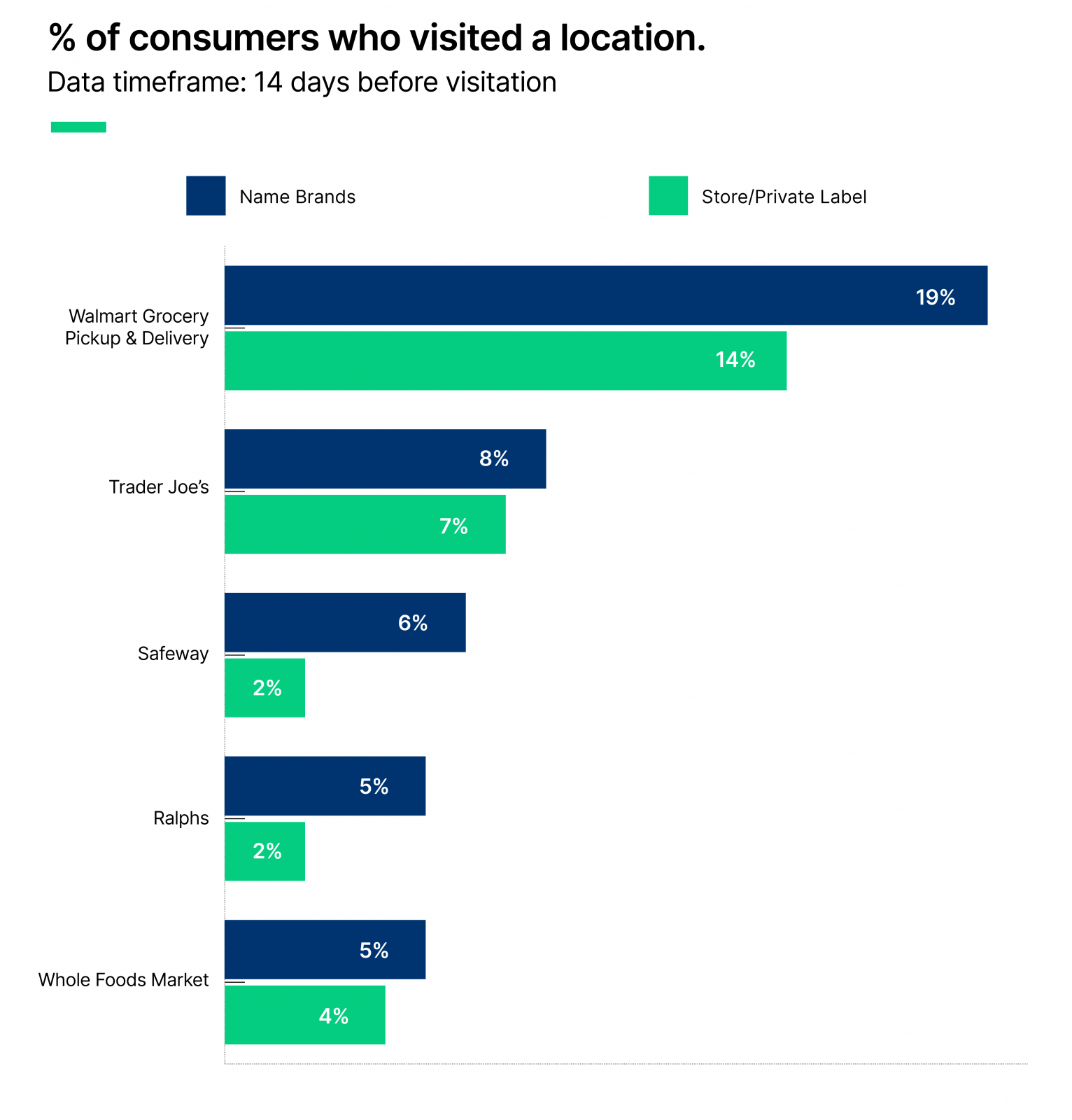

Take a look at Walmart. Now, they’re known for their low prices. So, you’d likely assume that the people who shop there come from a lower income bracket.

But, you’d be wrong.

In fact, Americans with incomes over $100,000 are now flocking to Walmart.2

Looking to save money, their efforts go to show just how tightly the upper middle class is being squeezed by rising prices. The effects are harmful, to all buyers, as we started to see a few months back.

Now, shoppers are taking a stand.

To save money.

There’s more.

This data isn’t exclusive to Walmart. Kroger and Publix shoppers making $100k+ are also reporting stronger preferences for private labels vs. brand names. In fact, this group sees a more significant lift in private-label grocery shoppers than any other income group.

Wow.

That hits home.

You can’t be wealthy if you spend everything you earn. So, as the tech layoffs increase3 and Americans scramble – it appears everyone is also pulling back on pandemic spending habits. We’re witnessing the financial habits of the upper-income segments in action – as they frantically find ways to spend less, in an increasingly down economy.

Now what?

It’s time to adapt.

I know, I’m sick of all these changes, but we can’t give in to the doom and gloom of a down economy. So, listen up. If you work for a grocery store, here’s your chance. This data clearly points to a new demographic. One you can zero in on before the competition does.

Yes.

I’m talking about the upper middle class.

That’s the income bracket to promote private label brands to. They’re all ears. Take your 2023 marketing dollars and invest in a higher-income segment. If you can, allocate additional advertising dollars to continue supporting your usual buyers, while doubling down on new ones.

Don’t get left behind.

It’s a perfect time to survey your buyer segments, like the one we see at Kroger, above. This market we see at Kroger is hyper-attracted to private labels. Dig into the data and find out why, and what they want from your brand. See what’s driving their behavior. Then, tap into their needs with razor-sharp messaging and ad spending that’s headed straight for their needs.

You’ve got this.

If you need to study app, web, or in-store behaviors – or reach a certain buyer segment – get it here. You can use a 7-day trial to tap into your target market for free, right now. You’ll keep all the insights you glean, and if you choose to stick around, the price is just $100/month.

Now, go win a new demographic, and build a retail empire.

References:

1. https://econation.one/blog/earn-more-or-spend-less/

2. https://www.businessinsider.com/walmart-inflation-upper-middle-class-shoppers-save-money-2022-8