‘Tis the season of giving. This year, you’ll get an all-access pass to first-party data and the decision-making behaviors of smartphone consumers—may it help build your brand and beat the competition.

Here we go.

Consumers who buy new phones – use payment apps – a lot.

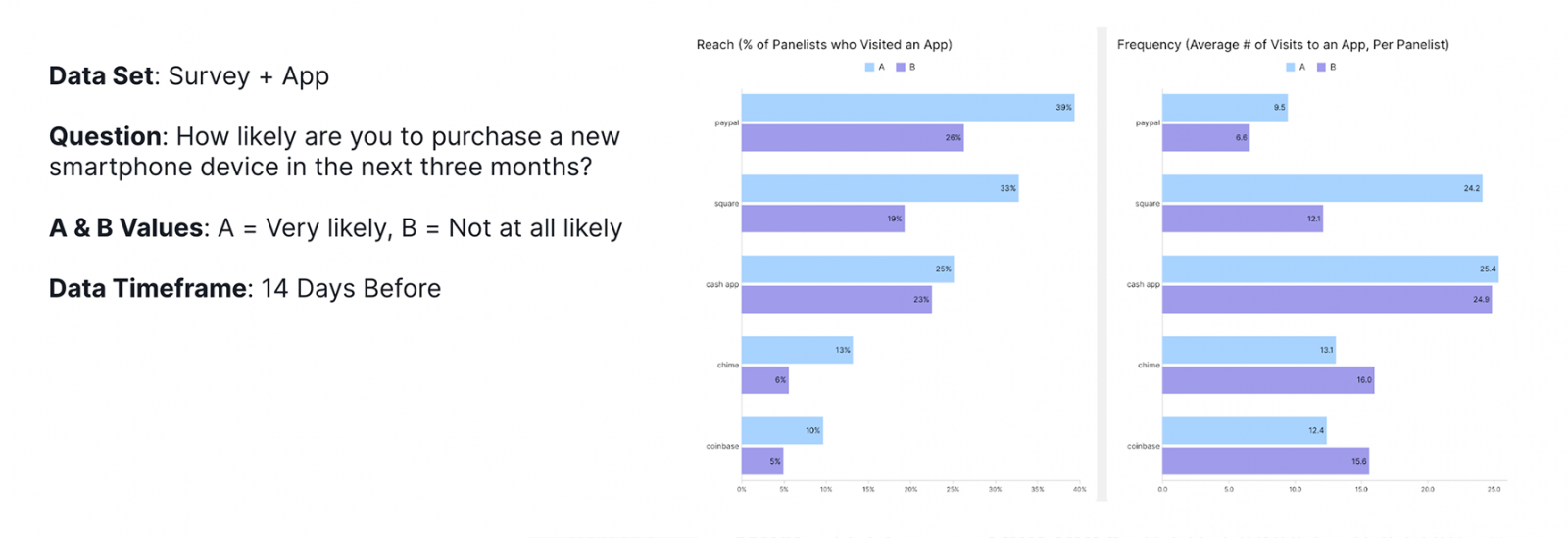

See below the consumers’ survey data who are “very likely” to buy a new smartphone between now and early next year, and you’ll see a trend. They have significantly higher use of payment and finance apps. At 39%, PayPal has the most visits, followed by Square and Cash App.

Why is this important?

Figure 1: Consumers buying a new smartphone are using payment/finance apps.

Well, it tells you where to advertise.

Picture this. Let’s say you’re a smartphone brand looking for brand-new advertising channels. You need to go where your competition isn’t, and grab market share. Now, you’ve stumbled across this consumer survey and behavior data. It shows your target market is hanging out in a payment app.

Imagine all the success you’d see…if you were the only ad player in that space.

Your competition isn’t there. They’re completely unaware. This data offers a beautiful way for you to get ahead in the new year, in spite of the competition, and a crowded marketplace.

But, wait, there’s more.

You can tell exactly what kind of audience to reach, and firm up your strategy in this channel with just a bit more digging. That way you can determine the content and message to share.

I’ll show you how.

Notice how PayPal is the most popular, but not the most frequented app. That distinction goes to Cash App at 25 visits, and Square at 24 visits. Getting this information can tell us a lot about the age, income, and education of your target market, to really determine if it’s the best fit.

Once you know it’s the right group, you can place new ads.

Let’s take a look.

The profile of a payment app user.

Here you go.

With more than 1.5 billion smartphones sold each year, the majority end up in the hands of college graduates who spend 90% of their time on apps.1 Surprised? You shouldn’t be. That profile aligns perfectly with what market research pros want. Smart, busy people who have money to spend on a new phone. Now, let’s compare that ideal customer profile to more payment app users.

They’re young.

It’s true. In fact, 94% of Millennials (ages 24-39) tend to use mobile payment apps — followed by 87% of Gen Zers (ages 18-23). So, as advertising channels go, placing an ad in a payment app means you’ll be reaching a younger audience who’s pretty tech savvy, by nature. At 53%, this group is making online purchases to retailers, keeping a balance of $287 in their mobile payment app account, and using that app at least weekly, so they’re likely to see your ads.2

All of these signs point to “go” when it comes to aligning to the buyer of a new smartphone. That means the ad channel is promising. It checks out further when you uncover that 84% of consumers have used a mobile banking app at least once.3 Not only can your reach your younger crowd who’s very familiar with mobile banking — but you can hit their parents too.4

Here’s your shot.

At 70%, Gen Z is overwhelmingly likely to want an iPhone.5 So, if you’re looking to take market share from that group, finance apps may offer you a perfect place to advertise. You’re likely to be the only one in this channel advertising to a very captive audience. And, bonus points are available, as you can pick up Millennials and Gen Xers along the way.

Need more? On MFour Studio you can explore more than 550 million app, web, and location data behaviors. It’s SaaS market research making data science easy. Take a look at the world’s largest consumer data platform; free for 7 days.

References:

- https://www.zippia.com/advice/smartphone-usage-statistics/#:~:text=To%20find%20out%20more%20about,a%20smartphone%20as%20of%202022.

- https://www.nerdwallet.com/article/banking/mobile-payment-app-survey

- https://www.lendingtree.com/personal/peer-to-peer-services-survey/

- https://www.cnbc.com/select/why-millennials-gen-z-use-mobile-banking-apps/