You should see this.

Two weeks ago, we touched on two Americas, the shoppers emerging from Dollar General and Whole Foods. It was a tale of the “haves” vs. the “have nots.”

Yes, America is still divided.

This week, we’re talking about “in-store” vs. “online” shoppers.

The pandemic has changed so many behaviors — it’s forever altered the face of retail. And, with the massive amount of market share Amazon has, you’d think online shopping would be everything. But stick around, that’s not always the case.

So, where are consumers going?

Go on, take a peek… it’s okay, I know you want to. 😉

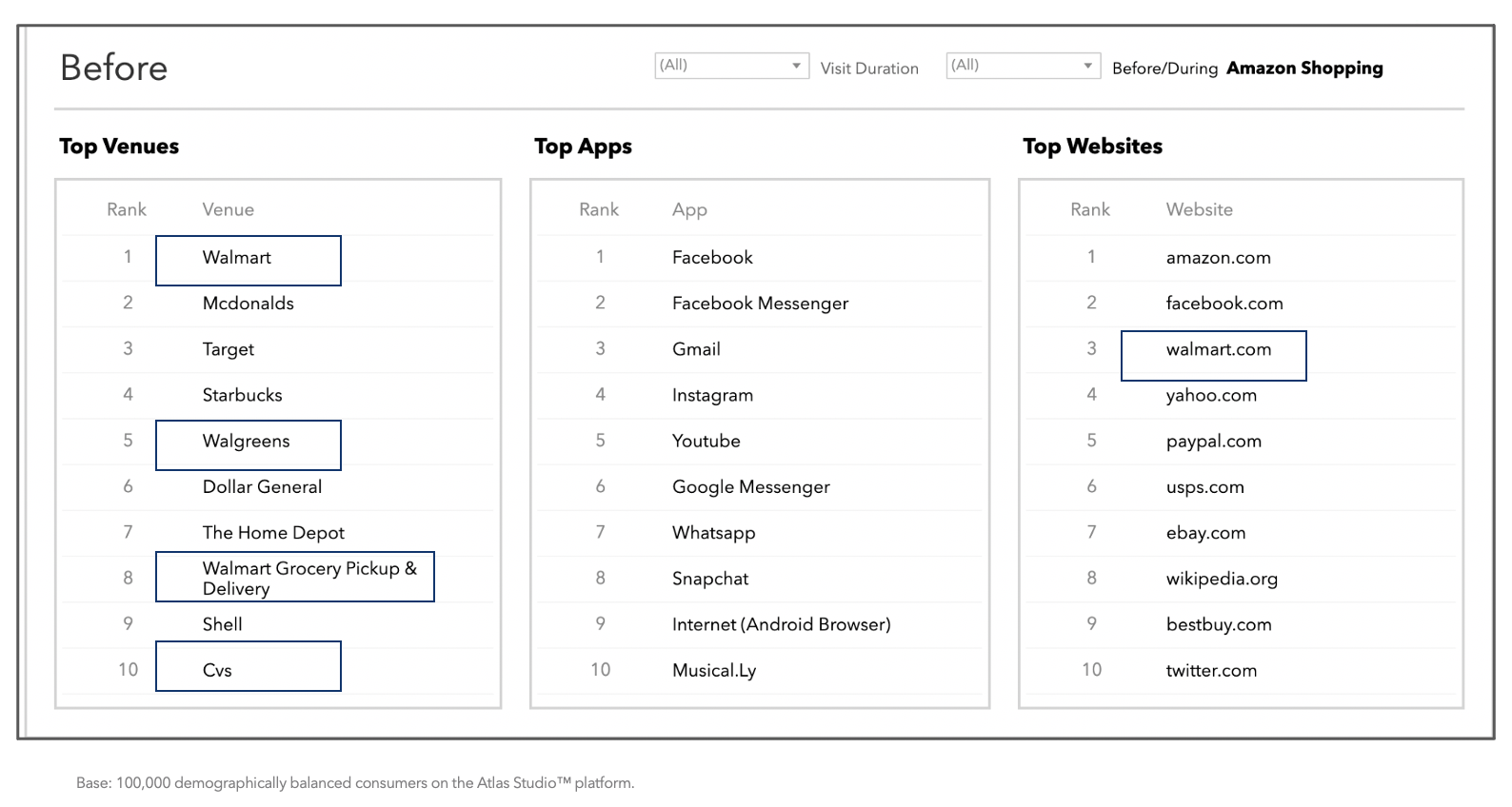

Do you see it too?

That’s right…

Walmart is the #1 venue Amazon shoppers visit.

You know, there’s a reason Walmart is ahead of Amazon.

The retail giant still packs a punch at 10,500 stores. Amazon may be #1 online, but they can’t compete at that level in-store. We’ve watched for years as these retailers remain fierce rivals.

Now, take a look at why.

It comes down to nostalgia.

Think back to Blockbuster. Do you remember being a kid, grabbing a movie after dinner? It was an experience that streaming can’t replicate. That behavior, the familiarity, lives inside in-store shopping too. So, while online is easier, in-store still has your heart — and a history.

Yet, unlike Blockbuster, in-store isn’t dying.

Here’s the proof.

As they leave Walmart, Amazon shoppers grab a bite at McDonald’s, or a snack at Starbucks. Then, it’s on to Walgreens or CVS; to pick up what they want now, not shipped in 2 days. These are price-conscious consumers; they want a deal, and Amazon is where they compare.

It’s a game of cross-reference.

You see a price in-store, you check Amazon as a source. Are the prices the same? Then, it’s a no-brainer. Your desire for instant gratification demands you buy in-store, not online. So, while eCommerce is way up in the pandemic, it fell quite a bit when in-store resurged.

Now, what?

Well, you focus on curbside delivery. Get buyers comfortable to help them convert. It’s why Walmart’s curbside is so popular with Amazon shoppers. It offers online convenience, with the comfort of in-store. It eases your hesitation. That’s the cure for buyers not yet ready to move on.

Meet buyers where they are.

In-store vs. online — who wins?

Neither, yet.

This is an evolution – a marathon, not a sprint.

No one is ready to leave either channel, in-store or online. For now, buyers still want both. And they will for a long time. Check out the actions of Walmart’s shoppers below.

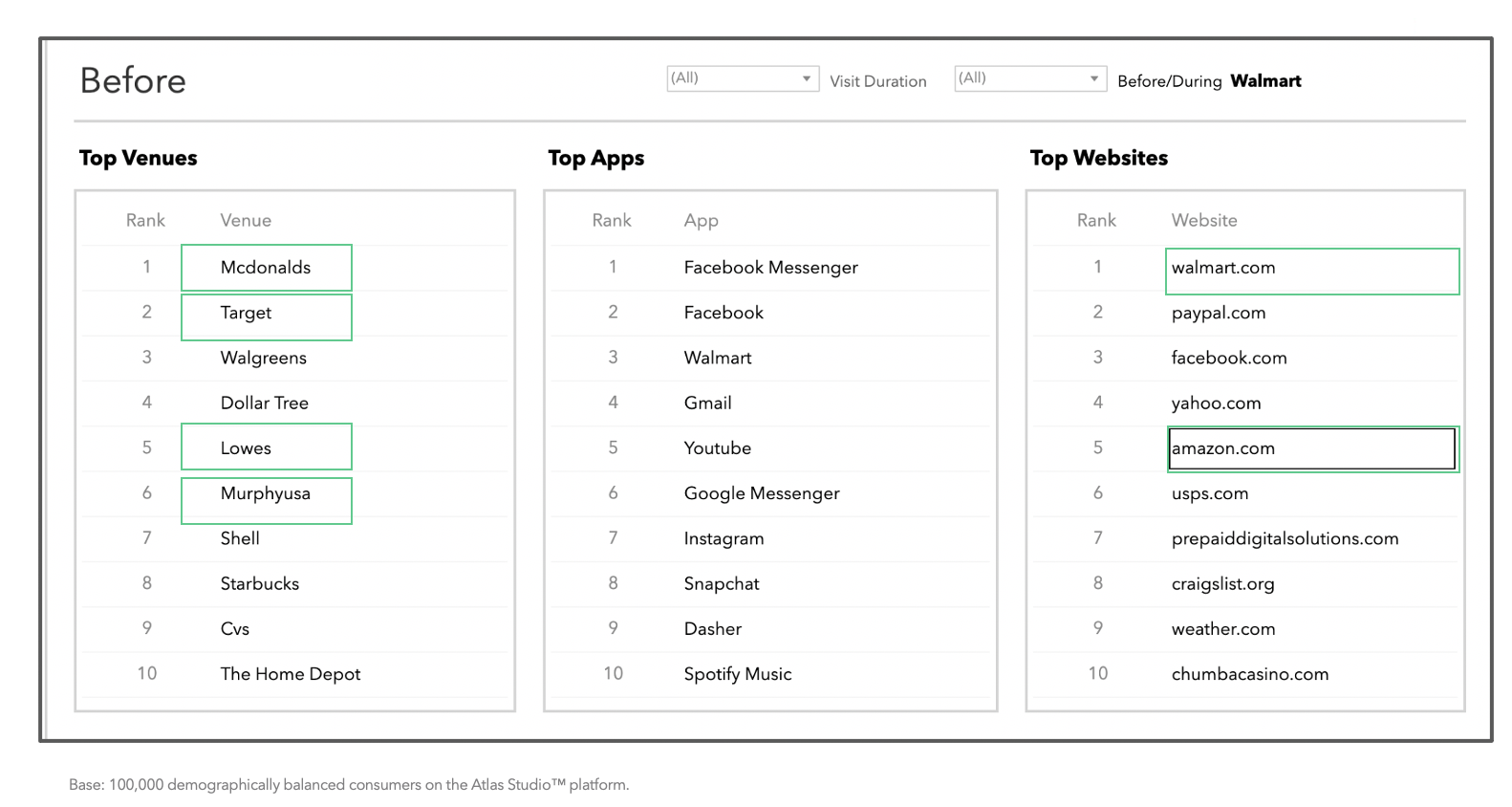

Do you see that?

It’s a mirror image of Amazon.

Why?

They’re the same buyer.

Now, there are subtle differences, this group is more likely to go to Lowe’s and MurphyUSA — than Home Depot and Shell, for example. But, that’s about it. They’re still comparing prices and hitting up Starbucks, before going in-store to shop.

So, aside from being a bit more price-conscious, shopping at Dollar Tree and McDonald’s, Walmart is really looking for the same person as Amazon is. And therein lies the competition. See, if you truly are vying for the exact same buyer, things are going to get ugly.

But, what’s it mean for your brand?

Today’s buyer is truly omnichannel. You need to meet them where they are.

Once shoppers are done on Amazon and in Walmart, they’re hitting up Best Buy, eBay and checking their digital wallets. They’re all over the place. And that’s exactly why you need a deeper understanding of what they’re doing. So, you can reach them any time — any place, no matter what.

Here’s some help with your marketing plans.

You have the power to beat your competition. Find out what they want and where they are. Then, build your moat around the channels real buyers are spending their time. Get contextual targeting, planning ideas, and the right product mix — all from your target market. All in one platform.

Let your research feed your revenue.

It’ll be how you differentiate your brand. Start today with a free 7-day trial.

References: